Pakistan maintained the tradition of receiving healthy workers’ remittances of over $2 billion for the fifth consecutive month in October 2020, helping the country’s foreign currency reserves to cover around three months of import bill.

Workers’ remittances increased 14% to $2.28 billion in October compared to $2 billion in the same month of last year, the State Bank of Pakistan (SBP) reported on Thursday.

The remittances remained flat compared to the previous month of September. Cumulatively, in the first four months (July-October) of current fiscal year FY21, the inflows surged a notable 26.57% to $9.43 billion compared to $7.45 billion in the same period of previous year, the central bank added.

“Receipt of workers’ remittances remains on the higher side as overseas Pakistanis continue to send money through official banking channels…due to restricted international travel (in an effort to contain the Covid-19 pandemic around the globe),” Tangent Capital Advisers CEO Muzammil Aslam said while talking to The Express Tribune.

He elaborated that earlier a number of overseas Pakistanis used to bring remittances in the form of hard cash along with them when they visited their families before the Covid-19 outbreak. Besides, the remittances continued to surge with the offer of better rupee-dollar exchange rate to the recipients in Pakistan and increased commission to international and domestic financial institutions on the transfer of remittances to Pakistan under the central bank’s Pakistan Remittances Initiative (PRI), he said.

Thirdly, the domestic authorities’ strong check over illegal transfer of funds to and from Pakistan in an effort to come out of the grey list of Financial Action Task Force (FATF) also helped ramp up remittances through the official channels, he said. He said such developments would provide much-needed support for increasing the inflow of remittances in future.

“Any slowdown in the receipt of workers’ remittances will be offset by the Roshan Digital Account (RDA) - which is being opened by overseas Pakistanis in Pakistani banks. RDA will take remittances to unforeseen high levels,” Aslam said.

He said RDA was a global product which was offering established overseas Pakistanis to not only maintain their accounts in their home country, but was also giving them easy and lucrative investment opportunities in different sectors of the national economy such as savings certificates, housing and construction and stock market.

They can pull out the investment and transfer funds abroad anytime as there is no restriction on the transfer of funds in and out of Pakistan under the RDA.

So far, over 40,000 overseas Pakistanis have opened RDA over the past couple of months.

Aslam estimated that total remittances would be somewhere between $25 billion and $25.5 billion in FY21 compared to $23.10 billion in the previous fiscal year.

AHL Research, however, estimated the full-year remittances at $24 billion. It anticipated that remittances would fall below $2 billion a month in the second half (January-June) of current fiscal year, barring the months falling close to Eid.

Earlier, Pakistan received inflows in the range of $1.78-1.9 billion per month in the prior five months - January-May 2020, according to the central bank.

The SBP said “improvements in Pakistan’s FX (foreign exchange) market structure and its dynamics, efforts under the Pakistan Remittances Initiative (PRI) to formalise the flows and limited cross-border travel contributed to the growth in remittances.”

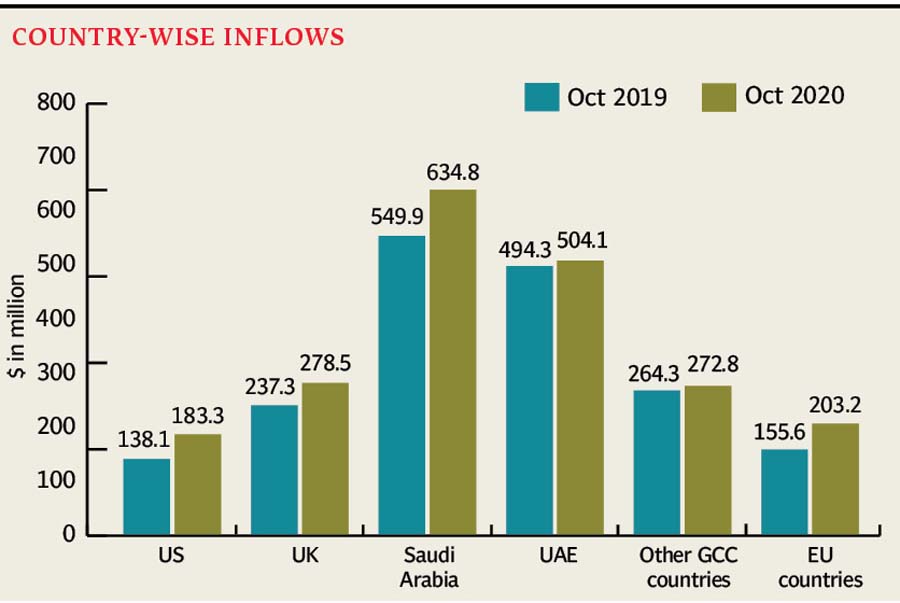

Country-wise remittances

The central bank said that non-resident Pakistanis sent higher remittances mostly from Saudi Arabia, United States and United Kingdom in October.

Remittances from Saudi Arabia surged 15.5% to $634.8 million in October 2020 compared to $549.9 million in the same month of last year. Inflows from the United States increased 33% to $183.3 million in the month under review compared to $138.1 million in the same month of last year. Remittances from United Kingdom improved 17% to $278.5 million from $237.3 million, while inflows from the United Arab Emirates enhanced to $504.1 million in October 2020 compared to $494.3 million in October 2019.

Published in The Express Tribune, November 13th, 2020.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

from Business News and Updates from the World of Commerce- eTribune https://ift.tt/3lqH3VS

No comments:

Post a Comment